Officials were ready to press charges. Then he revealed a loophole so obscure, even border agents had to check its legality.

Now others are quietly doing the same — and authorities are alarmed.

Madrid, Spain — June 2025

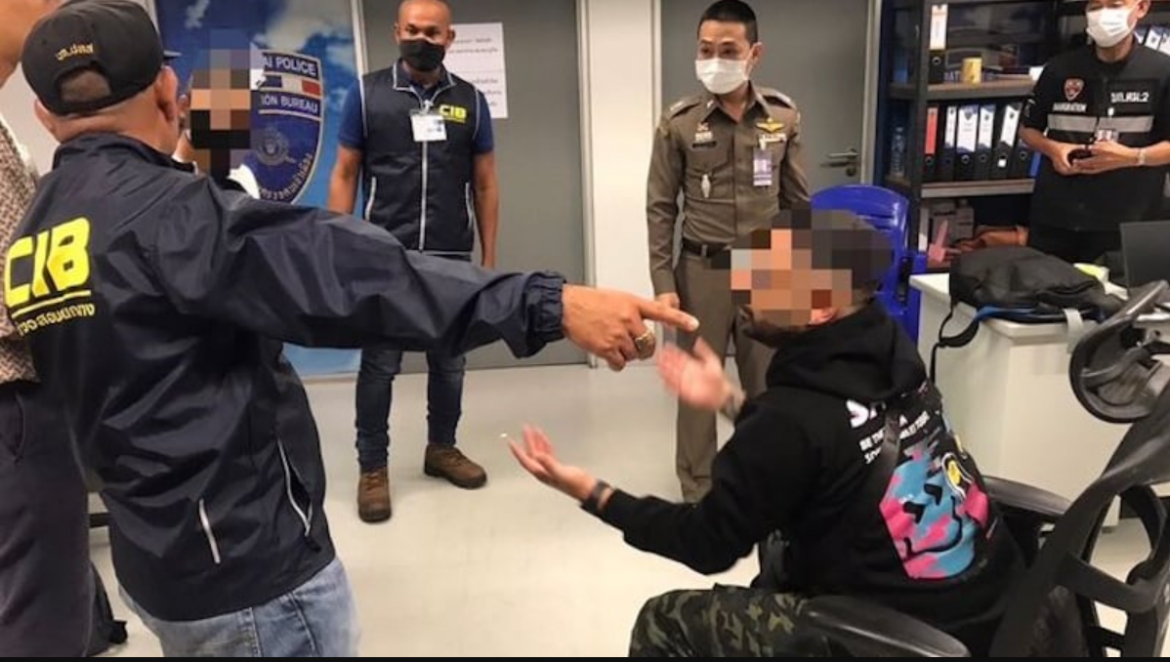

A 48-year-old Spanish national was detained at Adolfo Suárez Madrid-Barajas Airport after customs agents discovered multiple stacks of cash totaling €380,000 in his carry-on luggage. Initially suspected of money laundering or undeclared financial movement, the man’s calm response surprised everyone.

“I earned it legally,” he reportedly told the agents, offering documents that outlined an obscure but technically legal financial activity that allowed him to amass the fortune.

The cash was counted, recorded, and temporarily seized — but after a 48-hour review by the Spanish Tax Agency (Agencia Tributaria) and financial regulators, he was released without charges.

✅ So What Was the Loophole?

According to sources close to the investigation, the man had leveraged a legal classification of untaxed earnings related to international digital services that, under current law, do not require immediate declaration if sourced from outside the EU.

A small but growing number of Spaniards have begun using this model — often via legal consultations or private financial planning groups.

“It’s not fraud,” said a financial lawyer familiar with the case. “It’s the system working exactly as it was written. The problem is that almost no one knows about these provisions.”

🇪🇸 Why It Matters for Spanish Residents

Many citizens aren’t aware that certain income types, under specific thresholds and conditions, don’t trigger mandatory reporting or taxation right away — especially if generated from freelance work, alternative finance platforms, or royalties handled abroad.

These legal nuances are buried in the Ley General Tributaria and rarely applied at scale — but they exist.

📌 According to a 2024 report by El Confidencial, nearly 75% of eligible Spaniards have never claimed the legal benefits they qualify for under various income classes, deductions, or fiscal relief programs.

(Source: elconfidencial.com)

⚠️ Authorities Are Reviewing the Loophole

In light of recent events, the Spanish Ministry of Finance is reportedly exploring ways to tighten oversight around cash-based movement and related tax structures.

However, as of now, everything the man did is still legal.

Meanwhile, several websites have published step-by-step guides to understanding if one qualifies for similar income exemptions. Legal advisors say the window may close soon.

🟩 Check If You’re Eligible

A number of private consultancies now offer free evaluations for Spaniards who want to:

- Discover if they can legally access unused income or benefits

- Recover overpaid taxes

- Avoid missing deadlines or hidden compensations

- Plan future income in a tax-efficient way

✅ The check is free and non-binding — and could uncover thousands in missed opportunities.

“I just used the rules available to all of us,” the man was quoted as saying. “Most people just never look at them.”

Read more about legal financial paths used by Spaniards in 2025

📎 Full breakdown of untaxed earnings classes

📎 Updated Agencia Tributaria guidance

📎 Anonymous consultations available online

👉 Want to see if you qualify for legal income relief?

Tap here for a free check.